Balance Transfer – Move Your Loan, Save More with Grow Rupiz

Are your loan EMIs becoming too heavy? Do you feel like you are paying too much interest every month? Then a Balance Transfer might be the perfect solution for you. At Grow Rupiz, we do not give loans directly—but we help people like you find better options. We connect you with banks and NBFCs that offer balance transfer options with lower interest rates, better EMI plans, and more savings.

What is Balance Transfer?

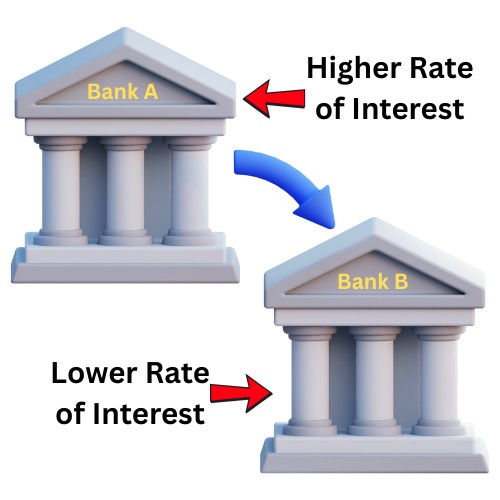

Balance Transfer simply means moving your current loan (home loan, personal loan, business loan, etc.) from one bank to another bank that gives you better terms.

For example:

- You took a personal loan at 15% interest.

- Now another bank is offering it at 11%.

- You can shift your loan to that new bank and enjoy lower EMI and save money.

This process is called Loan Balance Transfer.

Why Do People Choose Balance Transfer?

There are many good reasons to transfer your loan:

- Lower Interest Rates: The Biggest reason! Save thousands or lakhs by paying less interest.

- Lower EMIs: With lower interest, your monthly EMI becomes smaller.

- Top-Up Loan Option: Some banks give you extra money during the transfer process if you need it.

- Better Terms: You may get longer tenure, less paperwork, or better customer service.

- Improve Credit Score: Paying smaller EMIs on time improves your credit history.

What Types of Loans Can Be Transferred?

At Grow Rupiz, we help you transfer:

- Home Loan Balance Transfer

- Personal Loan Balance Transfer

- Business Loan Balance Transfer

- Loan Against Property (LAP) Transfer

- Gold Loan or Vehicle Loan Transfers

No matter the loan type, if you are paying high interest—we can help you move it to a better lender.

Who Can Apply for Balance Transfer?

Anyone can apply if:

- You already have an existing loan

- You have paid 6–12 EMIs (some banks ask for more or less)

- You have a stable income

- Your repayment history is mostly good

- You want to reduce your interest or EMI

Even if your CIBIL score is average, you may still be eligible. We will help you find the right lender.

Important Documents Required for Loan Transfer

Here are the documents you will need:

Basic KYC

- Aadhaar Card

- PAN Card

- Passport-size photos

Income Proof

- Salary slips (for salaried)

- ITR and business proof (for self-employed)

- Bank statement (last 6 months)

Existing Loan Documents

- Sanction letter

- EMI payment history

- Foreclosure letter (when ready to transfer)

We will guide you through each step so you do not feel lost.

How the Process Works

Here is a simple step-by-step guide to understand balance transfer:

Step 1: Connect with Grow Rupiz

You call us or fill out the form on our website.

Step 2: Share Loan Details

Tell us about your current loan—how much, from where, and for how long.

Step 3: Get New Loan Options

We show you better offers from our partner banks/NBFCs.

Step 4: Paperwork & Processing

We help with application, verification, and documentation.

Step 5: Loan Transfer & Savings

Your old loan is closed; a new one starts—with better terms!

Balance Transfer Example

Let us say you took a Rs. 5 lakh personal loan at 16% for 5 years. You have paid EMIs for 1 year. Still 4 years left. Now, you do a balance transfer to another bank at 11% interest.

- Your monthly EMI drops

- You save almost Rs. 30,000–Rs. 40,000 over the loan term!

Why keep paying more when you can pay less?

Why Choose Grow Rupiz for Balance Transfer?

We are not lenders, but we are your loan support system.

Here is why customers love working with Grow Rupiz:

- 100% Free Help: We do not charge you anything for our service.

- Trusted Lender Network: We only work with reliable banks and NBFCs.

- Easy Process: We explain everything in simple words—no confusing terms.

- Fast & Friendly: We value your time and treat every customer with care.

- End-to-End Support: From start to finish, we are always there to guide you.

How Grow Rupiz Helps in Balance Transfer

We do not offer loans directly, but we work with many trusted banks and NBFCs in India.

Here is how we make your loan transfer easy:

- Check Your Current Loan: We check how much you have paid and how much is left.

- Compare Offers: We look for banks/NBFCs giving lower interest or better terms.

- Contact Best Lenders: We speak with them on your behalf and present your profile.

- Help with Paperwork: We help you collect and submit the needed documents.

- Follow-Up Until Approval: We do not leave you midway—we stay with you till your loan is transferred.

Balance Transfer FAQs

Q: When should I do a balance transfer?

Best after 6–12 EMIs. If you are getting a lower rate, do not wait too long.

Q: Does balance transfer hurt my credit score?

No. If done smartly, it can even improve your score.

Q: Can I get a top-up loan during transfer?

Yes! Many banks offer top-up based on your income and repayment history.

Q: Are there any hidden charges?

Some lenders may charge processing fees. But Grow Rupiz helps you find the lowest cost deals.

Q: What is the interest rate I can get?

It depends on the type of loan and your profile. But we always try to get the lowest rate possible for you.